Founder Health, Impact & Scale Framework

A lifecycle-aware, founder-centric system for managing startup health, financial discipline, verified impact, and personal capacity.

Core Principles

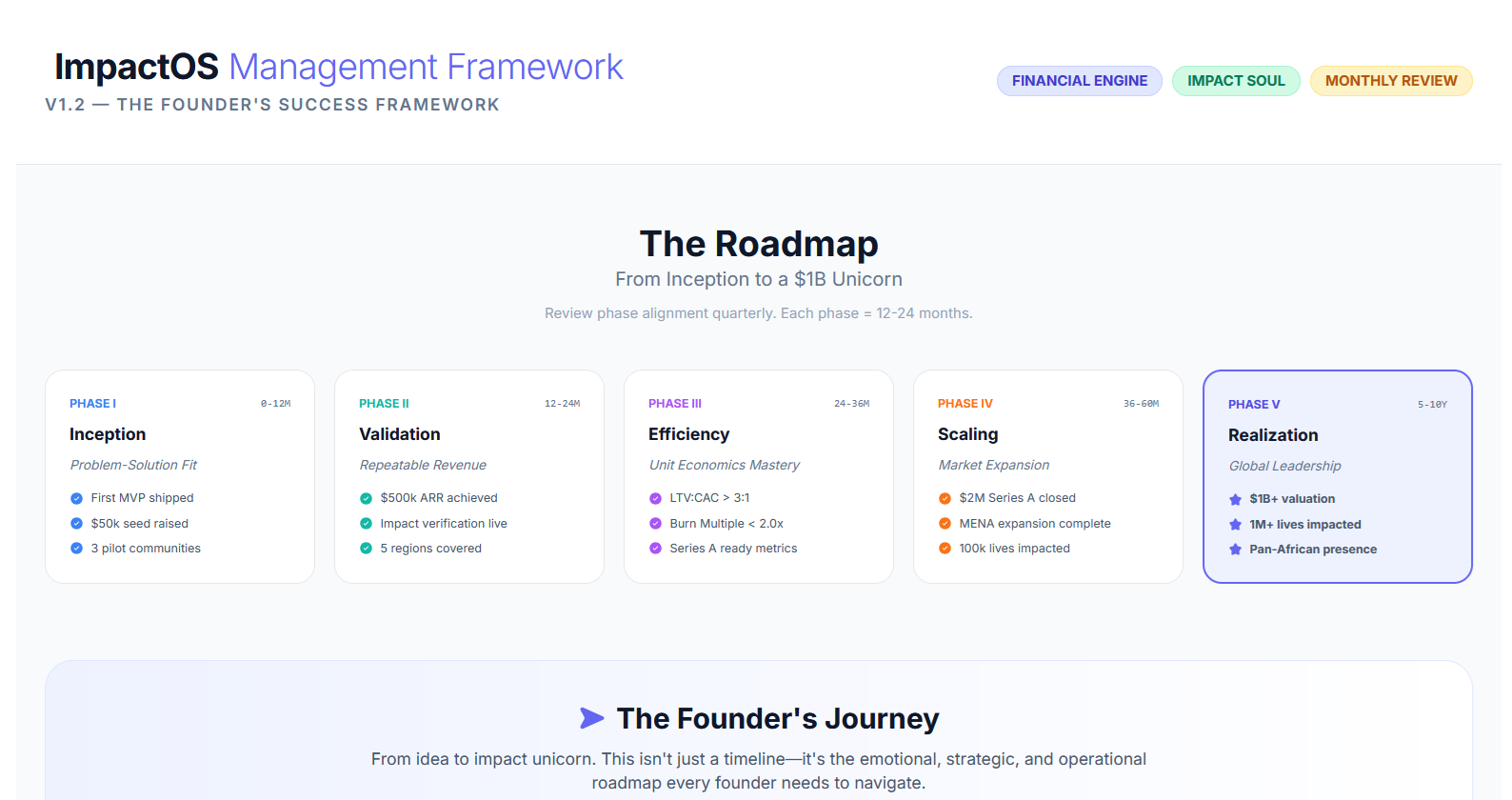

1. Phase States & The Journey

The “Phase Confidence Score” (PCS)

Think of this as your “Readiness Check.” Just because you can raise money doesn’t mean you are ready to scale.

0–12 Months

Phase I: Inception

The Problem-Solution Dance

Phase I: Inception

The Problem-Solution Dance

Focus Areas

- Customer Discovery: Find 50 people with the problem. Do they care?

- MVP: Build the ugliest, simplest version that solves the core issue.

- First Champions: Find 3–5 customers who love your vision.

- Impact Definition: Decide what you are measuring (e.g., “1 tree planted”).

⚠️ Top 5 Risks

- Building in Isolation (The “Lab Rat” trap).

- Cash Burn Misalignment (Spending on ads before product exists).

- Team Fragility (Co-founder disputes).

- Market Misreading (Solving a problem that doesn’t exist).

- Impact Washing (Claiming you save the world with zero proof).

You found 3 customers with a burning pain point, built a prototype in 90 days, and defined your impact unit.

12–24 Months

Phase II: Validation

From Love to Revenue

Phase II: Validation

From Love to Revenue

Focus Areas

- Pricing: Find the price point where customers buy without hesitation.

- Sales Playbook: Write down how you sell so you can hire someone else.

- Impact Proof (Internal): Use internal data as Proxy for impact.

- Core Team: Hire first non-founder managers.

⚠️ Top 5 Risks

- Premature Scaling (Hiring sales reps before you know how to sell).

- Feature Creep (Adding buttons instead of fixing the core).

- Burn Rate Acceleration.

- Founder-CEO Transition (Struggling to delegate).

- Impact-Revenue Gap (Making money but losing mission).

10–20 paying customers, steady revenue, and internal data confirms impact.

24–36 Months

Phase III: Efficiency

Mastering the Money Machine

Phase III: Efficiency

Mastering the Money Machine

Focus Areas

- Metric Mastery: LTV:CAC (SaaS) or Cash Cycles (Marketplace).

- SOPs: “Standard Operating Procedures.” Write manuals.

- Data Dashboard: Automate your reports.

⚠️ Top 5 Risks

- Growth Plateau.

- Culture Dilution.

- Burn Multiple Spiral.

- Impact Dilution.

- Competitor Response.

Margins healthy, cash flow positive (or trending), team works without you.

36–60 Months

Phase IV: Scaling

Market Domination

Phase IV: Scaling

Market Domination

Focus Areas

- Expansion: New countries or product lines.

- Executive Team: Hiring VP-level leaders.

- Verified Impact: Mandatory Third-Party Audit.

- Brand: Becoming the “Category King”.

⚠️ Top 5 Risks

- Cultural Missteps (Failing in new country).

- Cash Flow Mismatch.

- Execution Debt.

- Founder Burnout.

- Impact Verification Gap.

3+ regions, impact certified, 18+ months runway.

5–10 Years

Phase V: Realization

The Legacy

Phase V: Realization

The Legacy

Focus Areas

- Pan-Regional Power: Presence across the region.

- Policy Shaping: Working with governments.

- Ecosystem Building: Investing in next wave.

- Succession: Planning the exit.

⚠️ Top 5 Risks

- Innovator’s Dilemma.

- Bureaucracy Creep.

- Mission Drift.

- Founder Identity Crisis.

- Global Competition.

Verify >95% impact, company grows even if you take a 6-month vacation.

Golden Rules for Every Phase

Know your runway; never < 6 mo.

Great teams outperform mediocre ideas.

Must grow proportionally.

Focus obsessively on the phase key metric.

Fast decisions beat perfect decisions.

Most important asset. Protect it.

STOP: Calibrate Before You Measure

Do not use this framework without declaring your “Type” first.

Asset/Infra Heavy

Ops-Heavy / Marketplace

GovTech / Regulated

Deep Impact

Part 1: The Financial Engine

Infra: Calc Liquid Runway separately from CAPEX.

GovTech: Measure “Contract Value Added” quarterly.

Infra: Exclude CAPEX assets from Burn.

Commerce: Prioritize GMV Retention/Order Freq.

Ops/Agri: 15-20% acceptable if volume high.

Critical for EdTech/SaaS survival.

GovTech: Green zone extends to 12 months.

Super-App: Only count HQ staff (not drivers).

Part 2: The Impact Soul

If Revenue ↑ but Impact ↓ = Mission Drift.

Climate: Must be 100% Audited from Day 1.

Part 3: Meta-Layer & Zones

Founder Health & Risks

-

21. Decision Latency (Thndr Protocol)

Time from Signal → Decision. Founder stalling penalizes score. Regulatory stalling does not. -

22. Power & Dependency

Risk Check: Single client >40% revenue? Single Gov license? = “Red Zone”. -

23. Founder Health Index

Isolation >3 weeks since mentor talk = Danger.

Recovery <2 days off in 90 days = Danger.

🟢 Green Zone

Action: Continue & Optimize.

🟡 Yellow Zone

Action: Monitor closely.

🔴 Red Zone

Action: IMMEDIATE intervention.

🔵 Blue Zone

Action: Scale with caution.

Founder Rules (Unbreakable)

8. Practical Examples

Example 1: B2B SaaS (Inception)

-

Cash Runway

9 months (Yellow) -

MRR Trend

+10% MoM (Green) -

Burn Multiple

1.5x (Healthy) -

Phase Confidence

65% (Caution) -

Founder Energy

Moderate (Track)

Example 2: GovTech (Validation)

-

Rev Velocity

Slow but Signed (Green) -

Impact Verif.

Internal Only (Yellow) -

Geo Reach

2 Governorates (Yellow) -

PCS Score

70% (Fragility Detected) -

Founder Health

Stressed (Support Needed)

9. How to Use ImpactOS

Track all KPIs and update dashboards.

Recalculate PCS, identify risks, decide interventions.

Use simple traffic-light indicators.

Adjust strategy before problems become critical.

Founder’s Dictionary

Financial Metrics

-

MRR / ARR

Monthly / Annual Recurring Revenue. The predictable

“heartbeat” of subscription income. -

LTV : CAC

Life Time Value vs Customer Acquisition Cost. Profit

per customer vs cost to acquire them. -

Burn Multiple

Net burn divided by net new ARR. Measures capital

efficiency in growth. -

NRR (Net Revenue Retention)

Starting MRR + Expansion – Churn, divided by Starting

MRR. Measures existing customer health.

Impact Metrics

-

Impact Unit

Standardized measure of impact (tons CO₂ reduced,

liters saved, lives improved). -

SDG Coverage

The UN’s 17 Sustainable Development Goals—the global

language for measuring impact. -

Verification Rate

Percentage of impact claims verified by third-party

audit. No proof = No impact. -

ESG Premium

Additional valuation multiple or price premium

attributable to strong ESG performance.

Tools & Measurement

Leading: Predict future performance (sales pipeline).

Lagging: Historical results (revenue).

ERP (financials), CRM (customers), Impact Dashboard

(impact metrics), HRIS (employee data).

ERP: Accounting

CRM: Customers

SHOP: Sales

Metric Classification

Leading Indicators (Predict Future)

-

Sales Pipeline Value: Predicts future revenue -

Customer Satisfaction (CSAT/NPS): Predicts retention -

Product Engagement: Predicts expansion & churn -

Team Happiness Score: Predicts productivity

Lagging Indicators (Measure Past)

-

Revenue/ARR/MRR: Historical performance -

Profit Margins: Past efficiency -

Churn Rate: Historical customer loss -

Impact Units Delivered: Past impact achieved

Balance leading and lagging indicators for complete

picture. Review leading indicators weekly, lagging monthly.